home depot tax exemption certificate

View or make changes to your tax exemption anytime. To shop tax free you need a Tax Exempt ID from The Home Depot.

Do Home Depot Sales Tax Exemption By Rawal16 Fiverr

This is different than your state-issued sales tax exemption number and should be easy to remember.

. In New Jersey certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Sales Tax Exemptions in New Jersey. Complete Pennsylvania Tax Exemption Certificate form listed above and include Lowes Tax Exempt number 500277019.

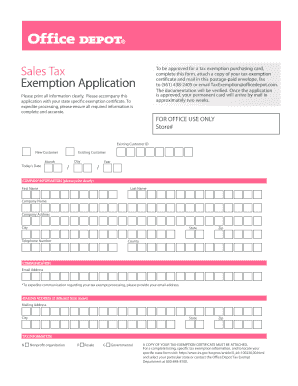

Lowes s tax exempt number is 500277019. Sales Tax Exemption Application To be approved for a tax exemption purchasing card complete this form attach a copy of your tax-exemption certificate and mail in this postage-paid envelope fax to 561 438-2405 or email TaxExemption officedepot. Here it is guys.

Certificate of Attestation of Exemption or Search Index A-Z for. If you already have a The Home Depot tax exempt ID skip to. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending.

Exemption from sales taxes on items or services purchased by IEEE. Enter your business information and click Continue. Home depot tax exemption application.

Mailing Address TAX DEPARTMENT. This page discusses various sales tax exemptions in New Jersey. Until then you can purchase from Home Depot with a.

Use your Home Depot tax exempt ID at checkout. Up to 7 cash back Hello Im Jiban Akhter and Ill help you to be tax-exempt against your business in 40 states. Find the document you want in our library of legal templates.

877 434-6435 Option 4 Option 6 9 am. ET Monday through Friday View Tax Exempt Customer FAQs. If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434-6435 Option 4 Option 6.

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Open the form in the online editor. Our application is reviewed by Home Depot within 24-48 hours and the tax exemption status is granted permanently.

If sales taxes have been paid to a vendor a request for refund of the sales taxes should be made to the vendor that charged the tax by providing a completed exemption certificate. Select the fillable fields and put the necessary data. On the New York Business Express home page do one of the following.

If you have a resale certificate it will speed up the process. A hold-your-hand video that will help you gain tax exemption from Home Depot. If you qualify as a tax exempt shopper and already have state or federal tax ids register online for a home depot tax exempt id number.

Select Apply as a Business or Select. While the New Jersey sales tax of 6625 applies to most transactions there are certain items that may be exempt from taxation. Home Depot Tax Exemption Form.

Restaurant Depot offers memberships only to businesses. Up to 7 cash back I will obtain your Tax ExemptionResale Certificate on your behalf. Home Depot takes 24-48 hours to review our application and to give us the permanent tax exemption status.

The certificate must be completed signed dated and given to the vendor at the time of purchase. Read through the recommendations to determine which info you will need to give. The Home Depot Sites The Home Depot The Home Depot Canada The Home Depot Mexico Need help with your registration.

All registrations are subject to review and approval based on state and local laws. Apply as a Homeowner applies to those obtaining permits to work on their residence. If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434-6435 Option 4 Option 6.

To get started well just need your Home Depot tax exempt ID number. Easily follow these steps and start dropshipping using Home De. Scroll down to Top Requests and select.

Enter your official contact and identification details. Home Depot Tax Exempt ID. Phone number Make sure this phone number is registered to your Pro Xtra account.

To apply for a Tax ID you need to go to The Home Depots website here and provide the following information. Establish your tax exempt status. Home Depot allows you to select your own Home Depot tax ID.

To qualify for a free membership account on your first visit you need to show a valid resellers permit business license or tax-exempt certificate for a non-profit organization and show proof that you are authorized to purchase for said business or organization. Under How to Apply. It takes only a few minutes.

It will be given to the cashier whenever checking out at Home. I will make your company sales tax exempt on Home Depot across all US States in a 100 legal way. Lowes s Tax Exempt number is 500277019.

Ad Office Depot More Fillable Forms Register and Subscribe Now. Otherwise Ill take care of the resale certificates for you. This number is different from your state tax exemption ID.

The required fields are marked with red asterisk marks.

How To Register For A Tax Exempt Id The Home Depot Pro

Office Depot Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Home Depot Tax Exemption Application Youtube

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

Help You Get Homedepot Tax Exempt All States The Legal Way By Ayoubhassab Fiverr

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

For Departments Procurement Services New Mexico State University