maryland digital ad tax lawsuit

Marylands digital advertising law imposes a tax on a percentage of revenues. By BRIAN WITTE February 18 2021.

A lawsuit seeking to block Marylands first-of-its-kind tax on social media digital advertising.

. Today internet association ia joined the us. The tax is imposed on entities with global annual gross. The Digital Tax imposes tax on gross revenue derived from digital advertising services in Maryland at.

The tax would be 25 million. Lawsuit argues states newly enacted tax on digital advertising revenue represents an improper levy on the internet. Maryland digital ad tax lawsuit.

This lawsuit seeks a declaration and injunction against enforcement of Maryland House Bill 732 as amended by Senate Bill 787 the Act insofar as it imposes a Digital Advertising Gross. Companies that make more than 100 million in global gross revenues annually would pay a 25 percent tax on annual revenues from digital advertising in Maryland. A lawsuit seeking to block Marylands first-of-its-kind tax on social media digital advertising revenue should be dismissed the Maryland attorney generals office argued in a.

Telecommunications giants Comcast CMCSA 15 and Verizon VZ 09 are the latest to sue Maryland over its first-in-the-nation. This lawsuit seeks a declaration and injunction against enforcement of Maryland House Bill 732 as amended by Senate Bill 787 the Act insofar as it imposes a Digital. Marylands digital advertising tax is the first of its kind in the US.

AP Marylands first-in-the-nation law taxing digital advertising by Big Tech companies like Facebook and Google is. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021. Maryland digital ad tax lawsuit.

Subscribe to our quarterly State and Local Tax Newsletter. The Act is a punitive assault on digital but not print advertising. Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue sourced to Maryland of 1 million.

Marylands first-in-the-nation law taxing digital. Maryland digital ad tax lawsuit. Late Monday tax law professors Darien Shanske and Young Ran Christine Kim filed a brief in a lawsuit brought by the Chamber of Commerce and Big.

Today netchoice joined a lawsuit against marylands digital advertising gross revenues tax hb 732. Wednesday March 17 2021. The Treasury of Maryland allege by and through their attorneys as follows.

Tax Professors Brief Aids Maryland. In February of 2021 Marylands Digital Ad Tax became law after the state legislature overrode the Governors veto. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of.

A coalition of trade organizations filed a lawsuit Thursday against the Maryland state government over passage of a bill that imposes a tax on digital ad revenue.

Fda Must Revisit Major Drug Compounding Policy Judge Rules Reuters

Vital Signs Digital Health Law Update Winter 2022 Jones Day

Opinion Marylanders Want The Ultra Wealthy And Big Corporations To Pay Their Fair Share Maryland Matters

Black Maryland Couple Suing After Home Appraisal Raises 278k With Whitewashing Nbc4 Washington

Gift Cards In Advertising Promotions And New York Sales Tax Jeffrey Marks

Maryland Lawmakers Approve New Map For General Assembly Districts

Ada News Updates On Accessibility Lawsuits And Legal Decisions

California Politics News Feed Los Angeles Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/QLLWBBDSKNBSDIGVSJBP3CQPBU.jpg)

Potential Lawsuits Threaten Millions Of Kentucky Taxpayer Dollars

Democratic Gop Contests For Maryland Governor Tight As Primary Nears The Washington Post

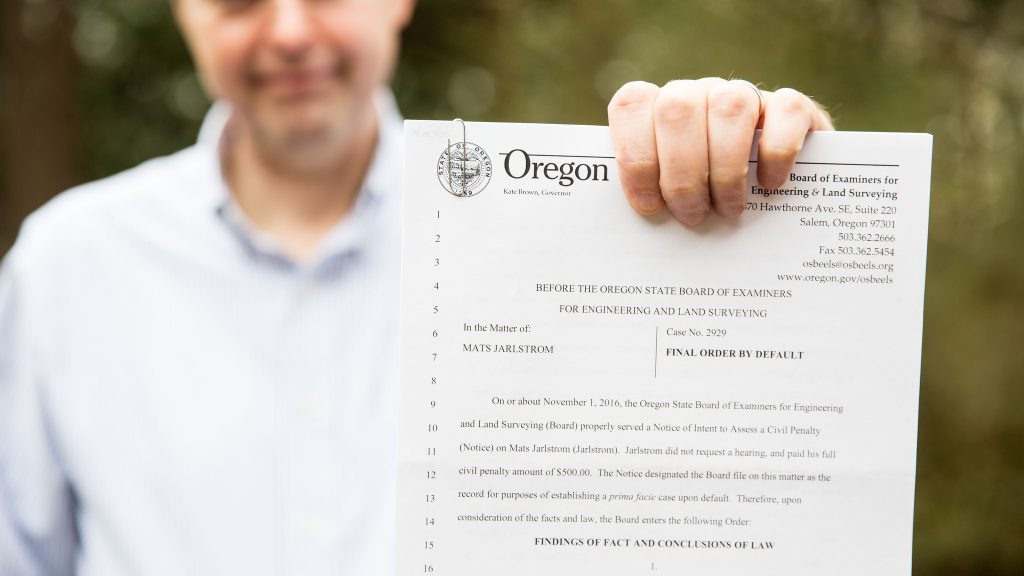

Oregon Engineer Wins Traffic Light Timing Lawsuit Institute For Justice

Ford To Pay 19 2 Million In Multistate Settlement Over False Advertising Allegations

Marylanders To Receive 2m In Restitution From Turbotax Settlement Baltimore Md Patch

Maryland Family Sues After Black 19 Year Old Died In Police Custody Nbc4 Washington

Class Certified In 401 K Plan Trustees Lawsuit Against John Hancock Planadviser